· Dayo Adetoye (PhD, C|CISO) · Partnering with the Business · 3 min read

Cyber Risk in Financial Terms:

Empowering Your CFO with Strategic Cyber Risk Insight.

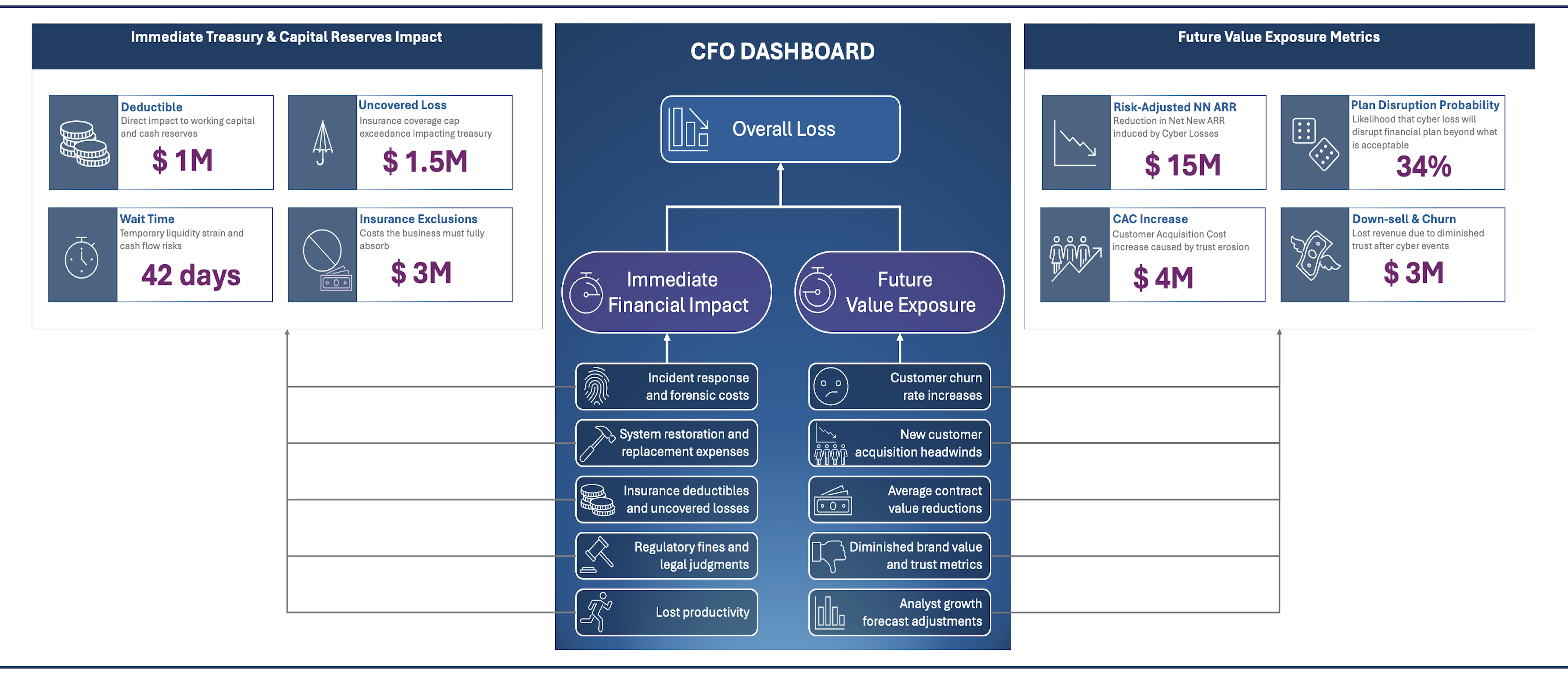

CISOs today must communicate cyber risk in terms CFOs and boards understand: cash flow, revenue disruption, and enterprise value. This article outlines a two-phase model for communicating cyber loss: Immediate Treasury Impact and Future Value Exposure, which aligns with how CFOs think about liquidity, treasury, cash reserves and growth risk. The approach allows CISOS to translate technical incidents into a financial narrative that supports strategic planning and investment.

Boards and CFOs don’t think in firewalls or threat actors: they think in cash flow, EBITDA, and enterprise value. If cybersecurity conversations don’t translate into these financial terms, they won’t attract the right strategic attention or investment. One of the modern CISO’s key roles is to communicate cyber risk in the language of the business - to enable smarter decision-making and long-range planning.

CFOs must plan for both near-term liquidity risks and long-term growth threats. Cyber risk spans both horizons, and structuring its financial impact accordingly helps the business prepare and respond effectively. This article introduces a two-phase loss model tailored for CFOs: Immediate Financial Impact and Future Value Exposure.

Immediate Financial Impact

Definition: Direct, quantifiable financial losses that impact current-period cash flow, EBITDA, and the balance sheet: typically incurred in the days and weeks following a cyber incident.

Positioning Immediate Financial Impact to the Board

Board Message: “These are the immediate, tangible costs that hit our financials post-event: cash outflows, EBITDA pressure, and short-term funding needs before insurance recovery begins.”

Key Metrics:

- Incident response and forensics

- IT/system recovery and business interruption

- Insurance deductibles and coverage gaps

- Regulatory fines and penalties

- Legal fees and crisis communications

Future Value Exposure

Definition: The longer-term financial drag caused by erosion of customer trust, market competitiveness, and growth potential: manifesting over quarters, not weeks.

Positioning Future Value Exposure to the Board

Board Message: “This is the long tail: the revenue loss, churn, and valuation pressure that persist long after the systems are back online. It affects our growth trajectory and investor confidence.”

Key Metrics:

- Increased customer churn

- Slower new business acquisition

- Reduced contract sizes or renewals

- Decline in brand equity and trust metrics

- Downward revisions in forecasts and valuation multiples

Want to see this in action? Try the interactive CFO Dashboard below.

Modeling Immediate Financial Impact and Future Value Exposure

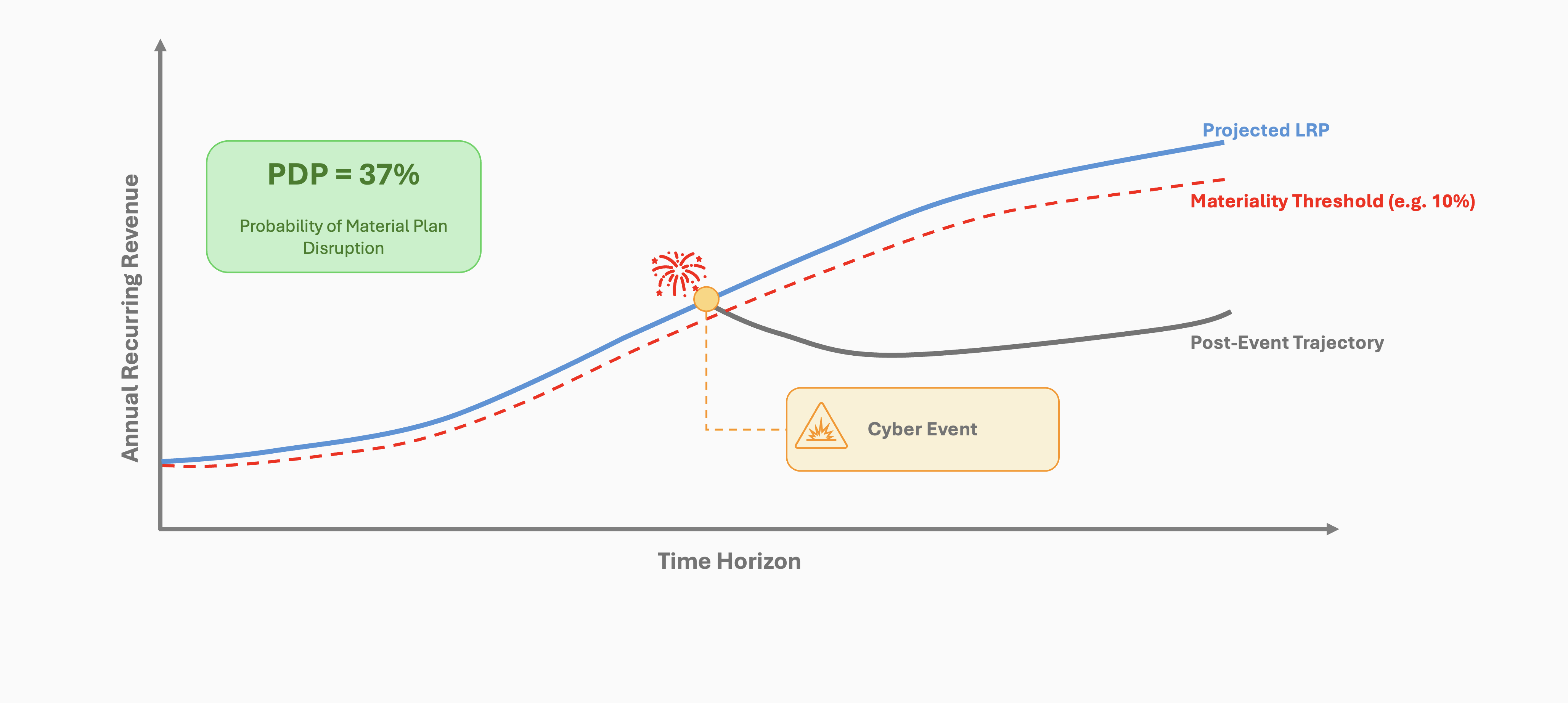

This two-phase model simulates cyber loss across two time horizons. For Immediate Financial Impact, we model insurance deductibles, payout delays, and the resulting treasury strain. For Future Value Exposure, we estimate how a material cyber event could suppress Net New ARR through customer churn and sales slowdown - and how that impacts your Plan Disruption Probability (PDP).

Together, these simulations give CFOs a full-spectrum financial view of cyber risk - critical for liquidity planning, insurance strategy, and safeguarding growth forecasts.

Plan Disruption Probability Tolerance Threshold: 5%

LRP Exceedance Probability Risk-Adjusted LRP

Loss Exceedance Probability

Board Talking Points for CISOs

Cyber risk plays out financially - first on cash flow, then on customer loyalty and market confidence.

Even with insurance, we face $X M in near-term funding needs. This is a liquidity planning issue.

Modeling shows that a $5 M hit to revenue leads to a $6M drop in enterprise value at our current multiple.

We can prioritize security investments that reduce both immediate cost and future erosion.

CISO Takeaways

- Communicate cyber in financial terms, not just technical terms

- Use Monte Carlo to simulate full-range outcomes

- Break losses into time-phased components

- Tie mitigation to business value protection

Closing: Speak the CFO’s Language, Influence the Business

Cybersecurity isn’t just a technical function - it’s a business enabler. When CISOs express cyber risk in the language of treasury, growth, and enterprise value, they earn a seat at the strategy table.

This two-phase model empowers you to frame cyber threats as financial risks to be managed, not just technical problems to be solved.

The dashboard above gives CFOs and boards a forward-looking view of cyber risk: not as an IT issue, but as a financial planning variable.

The result? Smarter planning. Better decisions. Stronger resilience.